Iam New to Stock Market. How to trade in Nifty Options Call and Put, what I need, Tell me in brief?

Options on the Nifty are mainly used by large fund managers to hedge their cash positions against large losses. They are also used by institutional and retail investors to speculate on the direction of the markets. This post is for someone who understands the basics of options and is interested in trading options in the Nifty. It details on the contract specifications, expiration dates and liquidity on the NSE for Nifty Options. It does not help with the Option Basics.

Follow the steps to learn how to trade options on the Nifty. What at all you need for successful trading in Nifty

1. Open an online trading account with a Discount Brokerage House. Activate the Derivatives Trading (some brokerages refer to it as F&O account) facility and transfer money to the separate Derivative account. Check out the Brokerage firms execution rate and reliability before creating an account with them.

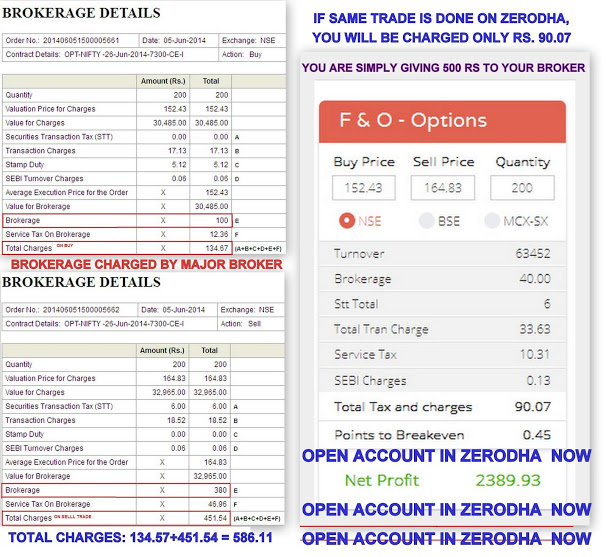

2. Iam using Zerodha. Zerodha charges Rs 20 per trade irrespective of quanty of the trade. Check the pic below for charges. You can even check the brokerages charged by Zerodha.com from the follwing link. See the comparison of brokerages charged by a leading broker and Zerodha. Contact ZERODHA NOW

2. Iam using Zerodha. Zerodha charges Rs 20 per trade irrespective of quanty of the trade. Check the pic below for charges. You can even check the brokerages charged by Zerodha.com from the follwing link. See the comparison of brokerages charged by a leading broker and Zerodha. Contact ZERODHA NOW

2. The options contracts are European style and cash settled and are based on the popular market benchmark S&P CNX Nifty index (Simply NIFTY)

3. 1 Lot or Contract of Nifty Option consists of 25 shares. 90% of the trades take place in the Near Expiration Contracts and liquidity is good.

4. S&P CNX Nifty options contracts have 3 consecutive monthly contracts, so that at any point in time there would be options contracts with at least 3 months available. On expiry of the near month contract, new contracts are introduced at new strike prices for both call and put options, on the trading day following the expiry of the near month contract.

5. An option is bought or sold by paying the option price * 25. eg. The Nifty is currently trading at 8400, the July Exp 8400 call is trading at 140. So, to buy one contract you pay 140*25 = 3500 Rs. (Some brokers gives you leverage but do not go for it you may loose more money).

6. The most active option in the Nifty normally trades around 2,00,000 contracts. ie. 1,00,00,000 shares.

7. The Option moves with the Nifty Futures and not the SPOT Nifty prices. So if the Nifty futures move up, the Calls too move up regardless of the SPOT Nifty price.

8. NSE Options expire on the last Thursday of the month. And in case the last Thursday is a holiday then the day before the last Thursday is the Expiration Day.

SMALL TIPS

1. Nifty Options follow Nifty Future prices and not the Nifty Spot price. You have to follow both the Nifty Futures and Nifty Spot prices.

2. Trend following strategies with stop losses work best for trading.

2. Trend following strategies with stop losses work best for trading.

3. Take positions giving more importance to the underlying price (in the case, the nifty price) than the option price.

4. Give room for the trade to move and set stop losses with the underlying in mind.

4. Give room for the trade to move and set stop losses with the underlying in mind.

5. Intraday trading is riskier , brokerage commission will play an important role in intraday trading, because it adds to the buying cost of a stock / future / option . If it’s high then it would be difficult for the trader to make some good profit intraday. Iam using zerodha it is harging Rs 20 for one lot or 100 lots (Irrespective of size of order) Uneed to open trading account with wonderful house. Iam using zerodha.com, he charges Rs 20 each order irrespective of size of order. Check the brockerages anytime with automatic calculator. If trading or speculating with options, it is best to have a fixed plan before entering a trade. That way there are no emotional decisions involved.

6. Options are best used to trade intra-day or hedge already existing cash or future positions. It's better to stick with Futures for trading with a longer time frame.

WARNINGS

1. Stop-losses have to be decided on before entering a trade.

2. It is always wise to trade only a small portion of the total capital until you understand the risks and rewards.

3. Carrying Option trades to the next day can result in extra commissions, and factors like volatility and loss of time value come into effect.

4. Options are very volatile instruments, and many factors influence its price.

5. Volatility, time value and the underlying price all have effect on the option price.

2. It is always wise to trade only a small portion of the total capital until you understand the risks and rewards.

3. Carrying Option trades to the next day can result in extra commissions, and factors like volatility and loss of time value come into effect.

4. Options are very volatile instruments, and many factors influence its price.

5. Volatility, time value and the underlying price all have effect on the option price.

Things You'll Need

1. An Online Trading Account with a brokerage which supports Derivative Trading (F&O Trading).

2. A Desktop Computer with UPS and/or Laptop.

3. Super fast 3G/Broadband Internet Connection.

4. Android Smartphone with 3G Internet loaded with trading app.

5. Most importantly subscribed for a web charts with automatic buy sell indicators.

3. Super fast 3G/Broadband Internet Connection.

4. Android Smartphone with 3G Internet loaded with trading app.

5. Most importantly subscribed for a web charts with automatic buy sell indicators.

Regards and Happy Trading

Thank you for your post. This is excellent information. It is amazing and wonderful to visit your site.

ReplyDeleteTop Cheapest Stock Broker in India